Approval of PA Qualified Opportunity Zones

The federal tax bill passed at the end of December 2017 enabled Governor Wolf to designate certain census tracts as Opportunity Zones. Investments made by individuals through special funds in these zones would be allowed to defer or eliminate federal taxes on capital gains. Governor Wolf was given the opportunity to designate up to 25 percent of census tracts that either have poverty rates of at least 20 percent or median family incomes of no more than 80 percent of statewide or metropolitan area family income. There were nearly 1,200 eligible census tracts and Governor Wolf designated 300 tracts based on economic data, recommendations from local partners, and the likelihood of private-sector investment in those tracts.

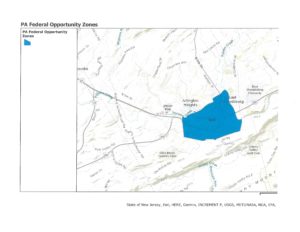

The Pocono Mountains Economic Development Corporation (PMEDC) submitted all eligible tracts in Monroe County for consideration. The only one that was selected for recommendation by Governor Wolf was the Borough of Stroudsburg.

DCED received robust feedback following the posting of the Opportunity Zones web page. Comments and recommendations were received from a total of 132 individuals, cities, counties, legislators, and organizations. A total of 734 eligible low-income census tracts were recommended to the state for designation, which is 61% of the entire eligible pool.

Tracts were recommended based primarily on potential to eliminate poverty, areas with business activity and geographic diversity.

On April 20, 2018, 300 tracts were submitted for designation as Opportunity Zones.

Following that submission, on Friday April 27, 2018, PMEDC learned that Internal Revenue Service (IRS) does not intend to have any kind of advance review process for qualified opportunity fund certification. According to the IRS website, to become a Qualified Opportunity Fund, an eligible taxpayer self-certifies. No approval of action by the IRS is required. To self-certify, a taxpayer merely completes a form, which will be released in the summer of 2018, and attaches that form to the taxpayer’s federal income tax return for the taxable year. The return must be filed timely, taking extensions into account.

“This is very encouraging for those developers who want to get these funds started as soon as possible without having to pass through a bunch of regulatory barriers,” commented Chuck Leonard, PMEDC Executive Director. “We will be spreading the word to prospects looking to do projects in the Stroudsburg area, especially Downtown Stroudsburg. This is an incentive that was not available until now.”

For more information visit https://dced.pa.gov/programs-funding/federal-funding-opportunities/qualified-opportunity-zones/

PMEDC is the economic development corporation serving Monroe County who is responsible for supporting business development, retention, financing and infrastructure development. More information can be found at www.PMEDC.com